News from The Bank of Marion

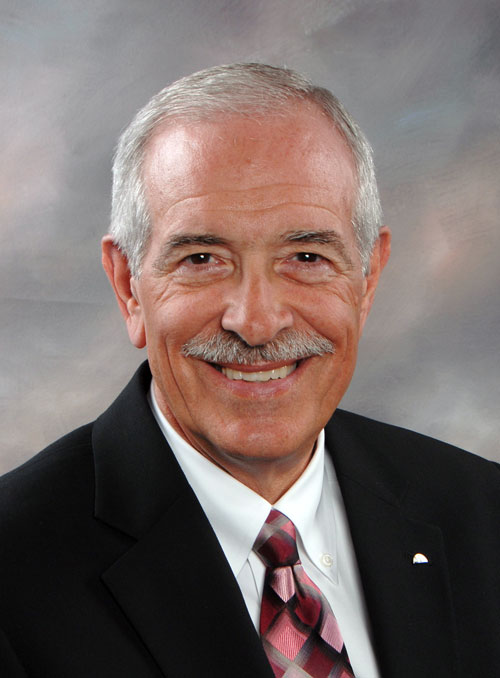

Branch Bank Manager Dan Porter Retires

The Fort Chiswell Branch of The Bank of Marion Has a New Manager

Marion, VA August 26 - Dan Porter has retired as the Manager of the Fort Chiswell Virginia branch of The Bank of Marion after 25 years of employment there. The Max Meadows resident joined the bank on July 1, 2000.

He was the bank’s first manager and until now, its only Manager.

Mr. Porter is a graduate of Rural Retreat High School, Wytheville Community College, and Tennessee Tech in Cookeville, Tennessee where he earned a Bachelor of Science degree. He was owner/manager of Mountain Empire Mortgage Broker, Inc. immediately prior to joining The Bank of Marion.

He has been active in many community service and local governmental organizations, including the Wythe County Board of Supervisors, the Wythe-Bland Public Service Authority, the Wythe County Planning Commission, and the Max Meadows Ruritan Club. He is a current member and Lay Leader at Grahams Forge Community Church.

Mr. Porter and his wife of 54 years, Susan Manuel Porter have two children and four grandchildren.

Mr. Porter said, “I feel very fortunate to have had a position where I could help others. I enjoyed being a part of The Bank of Marion’s leadership and all the employees and customers I got to work with over the past 25 years.”

“Dan Porter has been a superb branch manager for our banking organization,” said Chris Snodgrass, President and CEO of The Bank of Marion. “For a quarter century, he has helped families, individuals, and business customers maintain financial success with loans and financing from his branch. We will miss him.”

Fort Chiswell/Max Meadows resident, Crystal Brown, is the new Manager of the Fort Chiswell branch. She joined the branch in 2019 and was formerly the Branch’s Office Manager and Customer Service Representative. She began her new duties immediately upon Mr. Porter’s retirement.

Dan Porter

Chad Barr Named to Bank Board

The Bank of Marion has named Chad Barr of Marion, Virginia to its board of directors.

Mr. Barr is the Vice President of Finance for the Virginia operations of CRH Americas Materials.

CRH is the largest vertically integrated supplier of building materials in North America and is the parent company of W-L Construction & Paving and Appalachian Aggregates, headquartered in Chilhowie, Virginia. W-L has eleven asphalt plants in Virginia, West Virginia, and Tennessee and employs more than 250 people.

Mr. Barr is a graduate of Marion Senior High School and Virginia Tech in Blacksburg, Virginia where he earned a Bachelor of Science degree in business with a major in accounting.

He is a member of the Ebenezer Lutheran Church in Marion, serves on the church council, and is Treasurer of the Hungry Mother Lutheran Retreat Center.

Mr. Barr enjoys Hokies sports and outdoor activities, especially fishing. Mr. Barr says his three children and two grandchildren are the accomplishments of which he is most proud.

“We welcome Chad to our board,” said board chairman Charles “Charlie” Clark in announcing Mr. Barr’s appointment. “His business background and vast experience in financial management will continue to strengthen our very accomplished board and The Bank’s capabilities in serving the region’s businesses.”

Mr. Barr said, “I was honored to be considered for this post and will help every way I can to ensure the bank’s continued success.”

Chad Barr

The Bank of Marion Prepares Time Capsule

The two final elements of The Bank of Marion’s year-long commemoration of its 150th Anniversary are scheduled to come together on Friday, December 13. That’s the date of The Banks 150th Anniversary Holiday Open House at all its branches and offices.

On display at The Bank’s downtown Marion main office on that date will be a Time Capsule containing items that reflect how things were in business, education, banking, and culture in 2024. The capsule will be opened in 2074 when The Bank celebrates its 200th Anniversary.

The Bank has assembled much of the contents for the capsule but is seeking more from individuals, businesses, and organizations in the community. Items for consideration should be taken to The Bank’s main office in Marion, or to any branch by Wednesday, December 10.

Items for consideration should be small. Flat items, such as brochures, newsletters, photos, printed programs, etc. are good fits. Be sure the items are identified with the donor’s name.

Items presented for inclusion in the time capsule can’t be returned.

The Bank’s management and staff thanks everyone for their participation!

The 150th Anniversary Holiday Open House features food and fun from 9:00 am until 5:00 pm Friday, December 13 at all branches and offices. A limited number of anniversary Christmas ornaments will be given away. Everyone can register for a chance to win a sugar-cured spiral sliced ham.

Ed Stringer Retires from The Bank of Marion’s Board of DIRECTORS

John E. “Ed” Stringer has retired from The Bank of Marion’s Board of Directors. The announcement was made by Board Chairman, Charles C. “Charlie” Clark.

Mr. Stringer joined the bank as an employee in 1980 and rose through ranks to become its President and CEO. Soon after Mr. Stringer came aboard, he was promoted to Assistant Vice President and Loan Officer. He later became Vice President for Loans and Compliance, followed by a promotion to Executive Vice President.

He was named President and CEO in 1996 and presided over the bank’s significant growth through the addition of branches, expansion of banking products and services, and the introduction of new customer-focused technologies. The bank now has 19 branches and offices throughout Southwestern Virginia and the Tri-Cities and employs 124 people.

Mr. Stringer resigned his employment with the bank on December 31, 2019, after 39 years of service, but remained on the board of directors until his retirement from that post in September of this year.

Interestingly, as the bank is celebrating its 150th anniversary in 2024, Mr. Stringer’s association with the bank totals almost one third of that time.

When Mr. Stringer retired as the bank’s President and CEO, Dr. Pete Mowbray, chairman of the bank’s board at that time called attention to Mr. Stringer’s community leadership this way: “Ed has always put the bank’s customers and communities first. Innumerable public schools, colleges, community development groups, civic clubs, charities, and countless other organizations have benefitted from our bank’s largesse and support under Ed’s leadership and direction.” According to Mr. Clark, the current board chairman, Mr. Stringer’s philosophy of commitment to the people and communities the bank serves has continued to guide his leadership in many decisions the board has made during his tenure.

“Ed’s service on the board has been very valuable to the bank,” Charlie said. “His wealth of bank management experience, his strength of purpose, and his dedication to always doing the right thing for our communities, customers, and employees are very much appreciated. And they set the standard for future board members.”

As a gesture of appreciation for Mr. Stringer’s years of service to the bank’s board, the directors made cash donations in his name to his favorite not-for-profit organizations: the Appalachian Heritage Music Foundation of Marion, which produces the syndicated PBS Television show, Song of the Mountains, and to Wytheville Community College.

“The Bank of Marion has been my life’s work,” Mr. Stringer said. “I am proud of the many great employees whom I brought aboard over the years. Many of these people now occupy key management positions at the bank and have contributed so much to its success.”

“My work with the bank’s board of directors has been very fulfilling,” he continued. “It afforded me the opportunity to help chart the course for the banks future.”

Mr. Stringer is looking forward to spending more time with his family and creating in his woodworking shop.

Ed Stringer

How does a $3,890 disaster relief donation quickly grow to $42,000?

Thanks to the efforts of The Bank of Marion and the Smyth County Community Foundation, that happened.

Marion, VA October 24, 2024 - On Friday October 4, employees of The Bank of Marion staged an in-house fund drive to help area victims of the recent high winds and flooding from Tropical Storm Helene. At the end of that drive, those employees had donated a total of $3,890 in relief funds. The Bank matched this amount by a factor of five, which added $19,450 to the fund for a total of $23,340. The bank then rounded that number up to an even $25,000.

Chris Snodgrass, the bank’s president and CEO reached out to the Smyth County Community Foundation to see if they could assist with the distribution of these funds to deserving individuals and communities.

Lynda Helton, Executive Director of the foundation, said they would not only handle disaster relief fund distribution in Smyth County but could match those Smyth County-designated funds. When the match was applied, the total donation climbed to $42,000.

The Smyth County Community Foundation is on a mission to promote health, wellness, and education for all Smyth County citizens. They recently added disaster relief to their mission list and set up the Smyth County Disaster Fund for the express purpose of assisting in relief of hardship brought on by such disasters as September’s tropical storm.

Many houses across Smyth County were damaged by the flooding caused by Helene. Several families have been displaced.

The Smyth County Community Foundation is partnering with Smyth County Administration to offer this fund to help cover emergency housing repairs and structural damages from the storm. The Smyth County Community Foundation is committed to assisting in efforts to return that housing to livable standards.

Both Ms. Helton and Mr. Snodgrass emphasized that one hundred percent of the donations to this fund are going directly to address issues caused by Helene in our communities.

Relief funding for local victims of Tropical Storm Helene grows by $42,000.

A symbolic check for that amount was presented by Bank of Marion CEO, Chris Snodgrass to Lynda Helton, Executive Director of the Smyth County Community Foundation.

Pictured left to right: Dave Fields, Foundation Board Member; Lynda Helton, Executive Director - Smyth County Community Foundation; Chris Snodgrass, President and CEO, The Bank of Marion. Brian Cregger, Bank of Marion Assistant Vice President & Commercial Loan Officer and Foundation Board Member & Treasurer; and Heather Gullion, Head Teller, Bank of Marion Main Office.

ICBA AWARD

The Independent Community Bankers of America (ICBA) has recognized The Bank of Marion for 150 years of service to its communities and customers. A commemorative award was presented to the bank on September 4th by Leah Edwards Hosmer, Vice President of ICBA’s Mid-Atlantic Region. Chris Snodgrass, the bank’s President and CEO accepted the award.

The Bank of Marion is observing it’s 150th Anniversary throughout 2024.

PRESTON RETIRES; BEBBER PROMOTED

Robert Grey Preston, Assistant Vice President and Branch Manager of The Bank of Damascus, has retired from that post after 22 years. He was the branch’s first and only manager until his retirement.

The Meadowview resident is a graduate of Patrick Henry High School, Appalachian State University, and the Graduate School of Retail Bank Management at the University of Virginia.

He is a former president of the Washington County Chamber of Commerce and a member of the Appalachian State University Alumni Council. He is also a member of the Appalachian State Yosef Club, the university’s primary fundraising organization for athletics. Yosef is the name of Appalachian State’s mascot.

Mr. Preston is a member of the Rock Spring Presbyterian Church in Glade Spring, where he serves as deacon.

“Grey has led our Damascus branch in a highly professional manner to great success and outstanding community service,” said Chris Snodgrass, President and CEO of The Bank of Marion. “We will certainly miss him.”

Mr. Preston said he was grateful for his team of talented and dedicated employees. He said, “I will miss them, and I will miss my great customers and the banking relationships I had with them.”

Mr. Snodgrass also announced that Teresa Bebber, a lifetime resident of Damascus, has been promoted to Branch Manager to replace Mr. Preston. Ms. Bebber has 41 years of banking experience. Like Mr. Preston, she also joined The Bank of Damascus when it opened in 2003.

Grey Preston

Teresa Bebber

The Bank of Marion Marks 150th Anniversary this Year

The bank is celebrating a century and a half of service to its customers and communities.

Marion, VA – 22 January 2024 The Bank of Marion has embarked on a year-long observance of its sesquicentennial. The bank is the third oldest continuously operating bank in Virginia and among the oldest in the United States.

The bank was founded by Marion businessman Minter Jackson and was chartered on February 11, 1874. The bank’s first board of directors held its initial meeting on March 17 of that year and the bank opened its doors for business on April 12, 1874. Mr. Jackson was named as the bank’s first president. There were just 37 states in the union at that time.

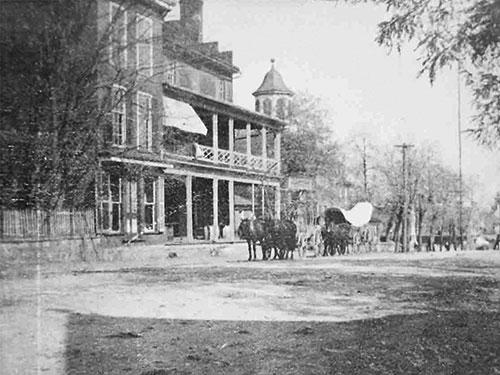

The Bank of Marion’s first home was in the “old Jackson building” - as the building came to be known - at the corner of Main and Park Streets in Marion. A photo of that building shows a covered wagon outside its front entrance.

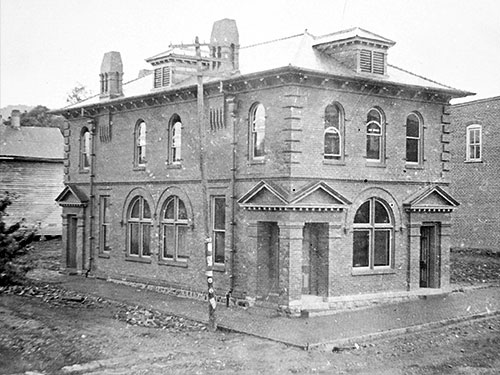

In 1897, the bank built its second home at the corner of Main and Church and served its customers from that location for a quarter-century. The bank’s current headquarters building was erected in that same location in 1922.

From these humble beginnings, The Bank of Marion has grown to 19 branches and offices extending from Johnson City, Tennessee to Radford Virginia.

Our first home in “The Old Jackson Building” at Main and Park in Marion.

Our second home at Main and Church erected in 1897.

Our current headquarters building at Main and Church was completed in 1922.

Bank of Marion V.P. Ernest Catron Retires

June 3, 2024 - Marion, VA

Ernest F. Catron has retired from The Bank of Marion after 42 years of service. Ernie, as he is known by his many friends and customers, joined the bank in 1981 and served in many capacities. At the time of his retirement, he was Vice President and Security Officer. He was The Bank of Chilhowie’s first branch manager when that branch was opened in 1987.

The announcement of Mr. Catron’s retirement was made by The Bank of Marion’s President and C.E.O. Christopher B. “Chris” Snodgrass. Mr. Snodgrass noted that Mr. Catron’s retirement came during the 150th Anniversary year of the founding of The Bank of Marion. “Ernie has been with our bank for nearly a third of its entire existence!”

Mr. Snodgrass went on to praise Mr. Catron’s service. “Ernie will be greatly missed,” he said. “Ernie was very well liked by his customers and his fellow bank employees as well. He was a tireless advocate for his customers, and they appreciated that.”

Mr. Catron is a graduate of Marion Senior High School and Emory & Henry College. He is a graduate of the Virginia Bankers School of Bank Management at the University of Virginia and the Graduate School of Banking School at Louisiana State University. He has always been active in civic groups in Marion and Smyth County, including The Chamber of Commerce of Smyth County, Downtown Marion, the Mount Rogers Planning District Commission, the United Way, and the Kiwanis Clubs of Chilhowie and Marion.

Mr. Catron is an active member of First United Methodist Church in Marion, having served in several leadership positions. He is a long-time member of the church choir.

About his career with The Bank of Marion, Mr. Catron said, “I am most proud of the relationships with my customers that I developed over these many years. Each customer is unique and has a special story.”

V.P. Ernest F. “Ernie” Catron

Remembering Mayor David Helms

We are deeply saddened by the passing of David P. Helms, our beloved mayor of the Town of Marion. Mr. Helms had held the post of mayor for well over two decades and was a tireless supporter of the town and its citizens. He possessed a unique and irreplaceable talent for viewing every proposed civic action in terms of its long-term effect on the community.

We worked closely with Mayor Helms on many projects and initiatives over the years. We will always remember his positive attitude, wonderful sense of humor, and ability to get things done. He was the ideal public servant.

I speak for the entire Bank of Marion family in expressing our heartfelt condolences to the Helms family.

Chris Snodgrass

President and CEO

The Bank of Marion

Mayor David P. Helms

Framed E&H Team Jersey Presented to The Bank of Marion

February 24, 2024 - At Emory & Henry College’s Senior Night men’s basketball game this past Saturday, The Bank of Marion was presented with an autographed and framed team jersey. The Bank is a major supporter of and donor to the Emory & Henry athletics program.

Pictured left to right are Khalil Shakir, Director of External Operations for Emory & Henry Athletics; Chris Snodgrass, President and CEO of The Bank of Marion; Kyra Bishop, member the bank’s board of directors; Charley Clark, Chairman of the bank’s board; and Clay Rolston, Director of Emory & Henry’s Corporate and Foundation Relations.

The framed jersey will be displayed at The Bank of Glade Spring, a branch of The Bank of Marion.

Dennis L. Jennings

Dennis Jennings Joins The Bank of Marion’s Board of Directors

December 18, 2023 – Marion, VA

Marion businessman Dennis L. Jennings has been elected to the board of directors of The Bank of Marion. The announcement was made by the board’s chairman, Charles C. “Charlie” Clark.

Mr. Jennings, a life-long resident of Marion, is Co-Owner and President of Slemp Brant Saunders & Associates Inc., an independent insurance agency founded in 1910. He joined the agency in 2008 and was named president and agency principal in 2017.

“We are pleased to welcome Dennis to our board,” said Mr. Clark. “We have worked with him closely over the years and have found him to be very accomplished and knowledgeable in many areas of business. He will certainly be an asset to our board.”

Mr. Jennings is a graduate of Radford University with a Bachelor of Science Degree in Criminal Justice. He is a past president and member of the Rotary Club of Marion and has been active in the Scouting program at First United Methodist Church since 2008 - serving as Assistant Scoutmaster and Troop Committee Chairman. He is a member of Independent Insurance Agents of Virginia.

Mr. Jennings is a life-long resident of Marion. He and his Wife, Oanya Sawyer Jennings, have five children.

With this appointment, Mr. Jennings is following in his late grandfather’s footsteps. The late W. Pat Jennings, Sr., U.S. Congressman 1955-1967, also served on the bank’s board from 1962 until 1989.

Upon his appointment, Mr. Jennings said, “It is both an honor and a privilege to join the board of The Bank of Marion. I am deeply grateful for this opportunity, and I am committed to working diligently and collaboratively with the board and the bank’s management team to further The Bank of Marion’s objectives and goals.”

The Bank of Marion Awards $50,000 to E&H Athletics

December 19, 2023 - Emory & Henry College, Emory, Virginia - Emory & Henry College Athletics is gaining attention and support as it moves toward full NCAA Division II status in the South Atlantic Conference. Such support is evidenced by a recent $50,000 gift from The Bank of Marion, headquartered in Marion.

“We are honored to be a part of the growth of Emory & Henry College,” said The Bank of Marion’s President and CEO, Christopher B. (Chris) Snodgrass. “We’ve witnessed firsthand the positive economic impact of the college’s School of Health Sciences here in Marion. We applaud the Emory & Henry athletic program’s move to Division II and the college’s investment in new facilities for their student athletes. We have already seen the college’s growth in enrollment. We are very pleased to be a part of this ambitious and exciting investment in Emory & Henry’s future.”

Snodgrass further commented that he and the bank’s board of directors were also impressed by the prospect of hundreds of Emory & Henry College students and thousands of local middle and high school students playing sports, including lacrosse, track and field, and soccer at the college’s new MultiSport Complex now in construction at exit 26 just off the I-81 Emory & Henry Education Corridor. It is estimated that the new sports complex will be ready for use by fall 2024.

Emory & Henry’s facilities stretch from Marion to Bristol and serve more than 1,400 students.

“This is a significant gift to our athletics community,” said Dr. Anne Crutchfield, vice president for athletics. “Support from The Bank of Marion will bring needed enhancements to our programs. We’re excited for the attention we are getting in the SAC and seeing how our fan base is growing too.”

The Bank of Marion is providing partial financings of the complex via a $10 million loan.

Founded in 1874, The Bank of Marion is the third-oldest bank in Virginia.

The Bank of Marion's - New River Valley Branch Opens

The Bank of Marion - New River Valley officially opened Friday, August 18 at 10 a.m. at 220 West Main in Radford, Virginia. The Radford Chamber of Commerce presided over a ribbon-cutting ceremony at the new bank. Open House for the public was also held that day.

The new bank will specialize in mortgage lending. Among the bank’s many home loan offerings is a no down payment home loan made and serviced by The Bank of Marion. That loan, the bank says, is for individuals and families who have solid employment and a good credit rating but haven’t been able to save enough money for a down payment on a home.

Business loans, personal loans, and financing of new home construction and land purchases will also be offered by the bank. It will not offer checking or savings accounts.

Mark Arney, a resident of the Poplar Hill community in Giles County, Virginia near Pearisburg, is the bank’s Branch Manager and Loan Officer. He is a graduate of the University of North Carolina, Asheville and has over 23 years of experience in the mortgage industry. He is a Virginia-licensed Mortgage Loan Officer.

Mr. Arney is a Board Member of the Shady Grove Church in Poplar Hill, the White Gate Ruritan Club, and a volunteer with the Fellowship of Christian Athletes Outdoor Program. In his free time, he enjoys cattle farming, woodworking, kayak fishing, and spending time with his wife, Susan Carr Arney and their Cavalier King Charles Spaniel, who, Mr. Arney says, “…thinks she is a farm dog!”

“We are very pleased that Mark has joined our bank as manager of our New River Branch,” said Chris Snodgrass, President, and CEO of The Bank of Marion. “His vast experience as a mortgage lender and his commitment to community service will be a valuable asset to a community bank such as ours and to this great region of Virginia.”

Mr. Arney said he was proud to be instrumental in opening the New River Valley branch bank. “I could not be more excited about the future of this branch,” he said. “Living and working in the New River Valley and doing what I love is a dream come true.”

The Bank of Marion was established in 1874 and is the third oldest bank in Virginia. Its New River Valley branch is the bank’s 19th branch or office in Southwestern Virginia and the Virginia-Tennessee Tri-Cities.

Charlie Clark, Chairman of The Bank of Marion’s Board of Directors, cuts the ribbon to officially open The Bank of Marion – New River Valley. He is assisted by Radford, Virginia Mayor, David Horton (to Mr. Clark’s left) and Chris Snodgrass, President and CEO of The Bank of Marion, (to Mr. Clark’s right.)

Mr. Snodgrass is flanked by Mark Arney, Branch Manager and Loan Officer; Mr. Arney’s wife, Susan, and Tim Carter, a member of the bank’s board of directors.