WELCOME NEW CUSTOMERS

You will be glad you switched.

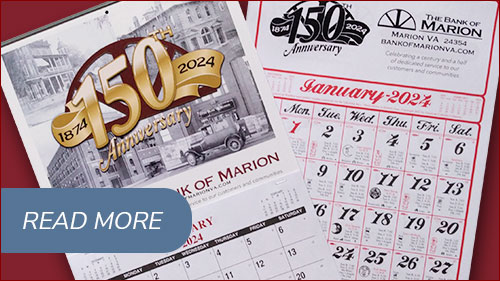

SURE TO BECOME COLLECTORS’ ITEMS…

Free! Your choice of commemorative calendars

while supplies last.

PUMP UP YOUR INTEREST EARNINGS

Check out our new CD rates and terms.

SIM SWAPPERS ARE STEALING PHONE NUMBERS

We're here to help.

THE HOME LOAN LEADER

Turn the equity in your home into cash!

BETCHA CAN'T BEAT THIS

Is this the world's best credit card?

Celebrating a century and a half of service to our customers and communities.